How deep is your J-Curve?

© bringga Content Board| PUBLISHED ON September 22, 2022

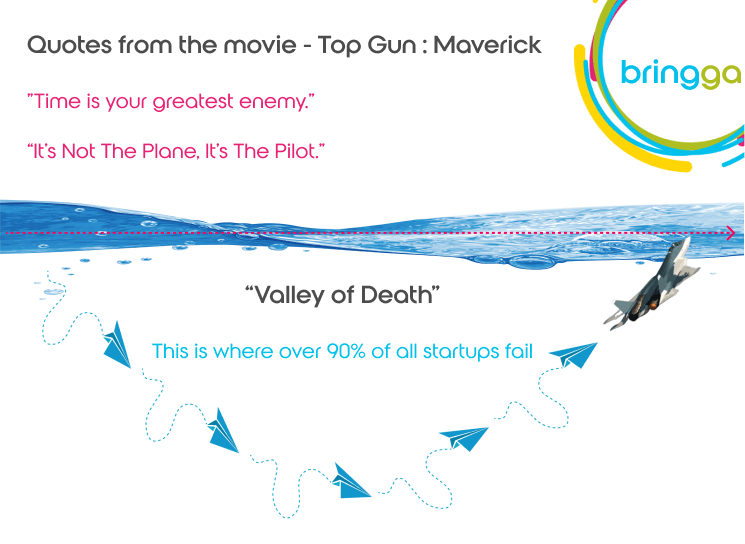

The suspense is over. After watching “Topgun: Maverick” last week, I could not help but share how much of what was said in the movie resonates with my views on the J-curve of startups. Here is my first part of the post on LinkedIn – https://lnkd.in/gJZsdvCp

Fund managers, for example, refer to the J-curve phenomenon as the “underwater period” before their investment portfolios hopefully achieve exponential returns. This negative period is sometimes referred to by traders as the “drawdown” before their trading portfolio or system begins to make a profit. When a company is not making a profit, accountants, and CFOs refer to it as being “in the red” in the accounting cycle. Among those involved in startups, this is commonly referred to as “the valley of death.”

Race to the Bottom?

So what did I discover through the film? Should I say rediscovered?

As Maverick puts it, “Time is your greatest enemy.”

In one scene in the film, Maverick and Rooster engage in a dogfight as they race toward Earth, which in some ways illustrates the truth of this statement for startups that are in a race to the bottom. Startups are trying to turn a flat piece of metal into a hypersonic fighter jet that hits cement or, as in the movie, the Mojave Desert, and then gets pulled up a very steep slope at 9 Gs before it runs out of room (or, in this case, capital) and matures through the J-curve stages into a real company that generates positive cash flow.

At that moment, I thought to myself, “Okay, next time I talk to Kyoung An, maybe I will tell him that I saw the movie and it was great…” while at the same time remembering where I was and what I was doing when I saw my first movie. When the fifth-generation Russian fighter jets corner Tom Cruise, Rooster comes out and says to Cruise,

“It’s Not The Plane; It’s The Pilot.”

Then it hit me again.

Exiting a J-curve becomes increasingly difficult as the company’s runway gets shorter, and the gravity it must overcome increases the deeper it enters the curve. As startup pilots, we need to pay close attention to how we “grow” our company to minimize the impact of the J-curve and ensure our survival in the valley of death. Until recently, expansion was the rule rather than the exception in our startup environment, resulting in an increasing need for new facilities, equipment, personnel, etc. As a result, the J-curve got steeper and steeper. Corporate spending, not revenue, increased with expansion. It would be disastrous if these expenses continued to grow without a corresponding increase in revenues, as the company would need far too many resources to maintain operations without being able to offset this with revenues other than investors’ investment capital.

Identify and mitigate potential triggers

So how do we mitigate the impact of this J-negative curve and increase the likelihood of achieving our business goals? Many think this is a chicken and egg question. However, one way is to focus on building a stronger brand identity and increasing sales without significantly increasing the number of people involved in the process. Building a strong brand means creating something memorable, unique, and valuable. Branding also helps us differentiate from our competitors and provides a foundation for future growth. Building a strategic relationship with another organization can also be helpful. These approaches may not work in every situation, but they’re worth considering if you struggle with a foothold.

There are numerous reasons for a downward trend in conversion rates and thus the J-curve. Here are a few of many that are most likely.

-Product-led growth is lacking, resulting in a high barrier to adoption

-Insufficient self-service interactions and onboarding

-A lack of internationalization of products and services

-Change in overall market conditions

-Change in customer preferences or needs

-A new competitor enters the market

-Change in the legal framework

-Labor costs rise due to falling productivity

-Identity and branding inadequacies

-Unbalanced product development, sales returns, and labor costs

You can protect your business from J-curve risk by taking steps to mitigate the impact of these potential triggers. Some risk mitigation strategies include:

-Diversifying revenue streams

-Improving forecasting and planning

-Building a global brand identity

While there is no foolproof method for avoiding a J-curve, knowing the possible causes and taking preventive measures can help. The most effective strategy for minimizing the impact is to anticipate the factors that could trigger a J-curve and then take action to mitigate its severity. By taking preventive action and acting strategically, you can improve your chances of surviving the phenomenon and emerging victorious.

There are numerous reasons for a downward trend in conversion rates and thus the J-curve. Here are a few of many that are most likely.

-Product-led growth is lacking, resulting in a high barrier to adoption

-Insufficient self-service interactions and onboarding

-A lack of internationalization of products and services

-Change in overall market conditions

-Change in customer preferences or needs

-A new competitor enters the market

-Change in the legal framework

-Labor costs rise due to falling productivity

-Identity and branding inadequacies

-Unbalanced product development, sales returns, and labor costs

You can protect your business from J-curve risk by taking steps to mitigate the impact of these potential triggers. Some risk mitigation strategies include:

-Diversifying revenue streams

-Improving forecasting and planning

-Building a global brand identity

While there is no foolproof method for avoiding a J-curve, knowing the possible causes and taking preventive measures can help. The most effective strategy for minimizing the impact is to anticipate the factors that could trigger a J-curve and then take action to mitigate its severity. By taking preventive action and acting strategically, you can improve your chances of surviving the phenomenon and emerging victorious.

Boost revenue and profitability

Startup J-curves exist, and they occur in every startup. They occur when a startup is just starting and not generating enough revenue to stay afloat. If a startup does not thrive during this time, it will likely never get another chance. Startups that make it through the J-curve often have a clear plan and the resources to execute it successfully. Investors have backed the founders’ ambitions to build a customer base and turn a profit. If such a strategy is not employed, they risk alienating investors and employees.

Regardless of what we call this time of uncertainty, it is an exciting time for any company facing various challenges and issues. It’s about turning around, generating revenue, and ultimately exceeding profits. During the J-curve, a new direction should often be taken for the company by embracing change. Companies should focus on what they do best and their core competencies during this time. It’s time to streamline operations and make them more efficient. It is also time to innovate and develop new products, services, or business lines to drive future revenue.

Companies can only survive in these uncertain times if they are proactive and flexible. They should focus on developing new products and services that meet the changing needs of customers. They also need to seek out and attract talented employees who can help them improve their performance. They must also be willing to change their ways if they are unsuccessful. These companies are innovative, responsive, and highly efficient. They understand managing risk effectively and are committed to delivering high-quality results.

Final Thoughts:

The J-curve is very challenging for startups and other businesses to survive. But maintaining a steady cash flow is even more difficult. Figure out what’s working and what’s not, then look for ways to improve everything you do. Think outside the box and experiment with creative ideas. Don’t pass up good products just because you have the wrong strategies. Look for ways to cut expenses and increase revenue. And remember, if you try something new, you’re likely to fail. So learn from those failures and move on.

Last but not least, you need effective marketing and good brand awareness: Keeping your customers and clients loyal to your brand will help your business grow and succeed. There are different marketing strategies, but not all of them are equally effective. When you invest in strategies that produce successful results, you can make the most of your valuable resources. By focusing on strategies that have proven to be successful, you can ensure that your marketing efforts contribute to the growth of your business. These changes will be difficult, but they are essential if you want your business to survive and thrive in this new environment. So take a deep breath, roll up your sleeves and get to work. The future of your business depends on it.

The longer the runway, the better the chances of flying out of the J-curve. Fortunately, bringga is on hand to help you.